WHY DO COMPANIES NEED VAT CONSULTANTS IN BAHRAIN?

In Bahrain’s fast-paced business hubs such as Manama, Hidd, Sitra, and Seef, VAT compliance is a legal requirement and a mark of financial transparency. Companies across industries must ensure proper VAT Registration, timely filing of VAT returns, and accurate documentation to remain compliant with the National Bureau for Revenue (NBR).

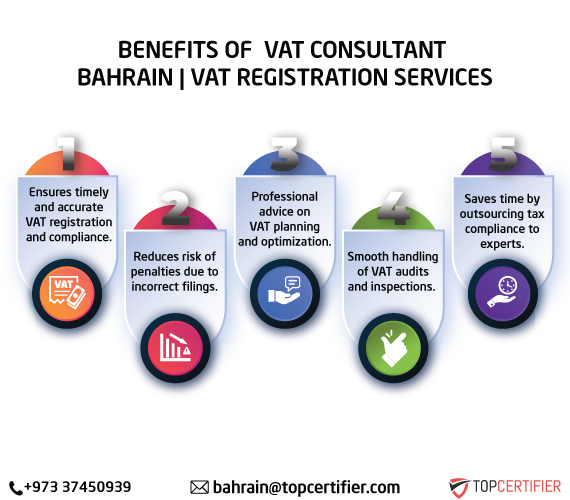

From SMEs in Salmabad to large corporations in Manama, businesses rely on VAT Consultants in Bahrain to navigate VAT laws, minimize risks, and optimize tax structures. Proper VAT management helps organizations reduce errors, avoid penalties, and maintain smooth business operations. The increasing demand for VAT consulting in Bahrain highlights its importance as a key business support service.

ESSENTIAL RESOURCES FOR UNDERSTANDING VAT SERVICES IN BAHRAIN

Know More About VAT Registration, Compliance & Filing

Understand Bahrain VAT laws, thresholds, and deadlines for VAT registration and return filing. Learn how VAT compliance ensures financial transparency, avoids penalties, and keeps your business fully aligned with National Bureau for Revenue (NBR) requirements.

A Clear Roadmap for VAT Registration in Bahrain

Follow our step-by-step VAT Registration process in Bahrain, designed for startups, SMEs, and large enterprises. From initial assessment to final approval, we simplify every stage to ensure smooth registration and compliance.

VAT Documentation & Record-Keeping Assistance

Ensure accurate VAT documentation, invoicing, and record maintenance to stay compliant with Bahrain’s tax laws. Proper record-keeping helps businesses during audits, reduces risks, and builds long-term financial credibility.

VAT Return Filing & Reporting Support

Get expert assistance for timely submission of VAT returns in Bahrain. Our consultants prepare accurate reports for the NBR, minimize filing errors, and help businesses avoid costly fines and delays.

Role of VAT Consultants in Bahrain

Discover how professional VAT Consultants in Bahrain help businesses register, file returns, and stay compliant with VAT laws. With expert guidance, companies can minimize tax risks, optimize structures, and focus on growth.

VAT CONSULTING SERVICES IN BAHRAIN BY THE BEST CONSULTANT IN BAHRAIN

As a leading VAT Consultant in Bahrain, TopCertifier provides end-to-end VAT services that help businesses stay fully compliant with Bahrain’s VAT laws while minimizing risks. Our expert team works with startups, SMEs, and large corporations to simplify VAT processes, reduce errors, and ensure financial transparency. Our comprehensive VAT services include:

We assist businesses in determining VAT registration requirements based on NBR thresholds, preparing accurate documentation, and completing VAT registration with the National Bureau for Revenue (NBR). Our guidance ensures a smooth, error-free registration process.

Timely preparation and submission of VAT returns is critical in Bahrain. We help businesses file VAT returns accurately, avoid penalties, and maintain compliance with Bahrain VAT laws. Our consultants ensure every return is properly documented and submitted on time.

Our advisory services guide businesses on VAT exemptions, impact assessment, and tax-efficient structuring. With tailored VAT planning, organizations can reduce liabilities, optimize cash flow, and align operations with Bahrain’s regulatory framework.

We prepare companies for VAT audits by identifying compliance gaps, ensuring accurate documentation, and minimizing audit risks. Our consultants provide full support to help businesses confidently handle NBR VAT inspections.

Proper documentation is key for VAT compliance. We ensure accurate VAT invoicing, bookkeeping, and record maintenance in line with Bahrain VAT regulations. This helps businesses stay audit-ready and avoid unnecessary compliance risks.

We conduct specialized VAT training sessions for employees to build awareness on VAT processes, compliance requirements, and reporting best practices. This empowers teams to manage VAT efficiently and reduces dependency on external support.

We provide tailored VAT consulting solutions in Bahrain that align with your company’s financial goals and industry requirements. Organizations that partner with TopCertifier benefit from smooth VAT Registration, accurate VAT Return Filing, and long-term compliance with the National Bureau for Revenue (NBR). Our expertise ensures that businesses in Bahrain maintain transparency, avoid penalties, and achieve sustainable growth.

With years of proven experience, TopCertifier is trusted by companies across Bahrain’s key business hubs such as Manama, Hidd, Sitra, and Seef. By leveraging our VAT Consulting Services in Bahrain, organizations can focus on expansion while we handle compliance, tax efficiency, and regulatory updates.

Trust Us To Lead The Way In Certification And Compliance

Knowledge And Expertise

Thorough Understanding Of The Framework, Its Requirements, And Best Practices For Implementation

Proven Track Record

Successful Track Record Of Helping Clients Achieve Compliance, With Positive Client Testimonials And Case Studies.

Strong Project Management Skills

Ensure The Compliance Engagement Runs Smoothly And Is Completed On Time And Within Budget.

Experienced Team

Possession Of Experienced Professionals, Including Auditors, Consultants, And Technical Experts

Exceptional Customer Service

Committed To Excellent Customer Service With Clear Communication, Responsive Support, And A Focus On Satisfaction.

Competitive Pricing

We Prioritize Delivering High-Quality Services With Competitive Pricing That Provides Exceptional Value To Our Clients

FAQs

FREQUENTLY ASKED QUESTIONS

Value Added Tax (VAT) in Bahrain is an indirect tax applied on most goods and services at a standard rate. Introduced under the GCC VAT framework, VAT in Bahrain is regulated by the National Bureau for Revenue (NBR) to enhance economic stability and government revenues.

Businesses exceeding the mandatory turnover threshold of BHD 37,500 must register with the National Bureau for Revenue (NBR). Voluntary VAT registration is also available for businesses with lower turnover to claim input tax credits and strengthen compliance.

VAT registration in Bahrain is done through the official NBR portal by submitting all required documents online. VAT Consultants in Bahrain like TopCertifier simplify this process by preparing documentation, verifying compliance, and ensuring fast approval.

Common documents required include a valid Commercial Registration (CR), audited financial statements, proof of annual turnover, bank details, and supporting business documents. Accurate submission ensures a hassle-free VAT registration in Bahrain.

VAT returns are usually filed quarterly in Bahrain. However, based on business size and NBR requirements, some companies may have monthly filing obligations. Timely VAT return filing helps businesses avoid penalties and stay compliant.

Businesses that fail to register for VAT in Bahrain may face heavy fines, penalties, and legal consequences imposed by the NBR. Early registration and proper VAT compliance help mitigate these risks.

Yes. Small businesses with annual revenue below the VAT registration threshold may not be required to register. However, voluntary VAT registration in Bahrain is recommended for businesses wanting to recover input VAT and build credibility.

TopCertifier provides complete VAT services in Bahrain including VAT registration, return filing, compliance checks, audit preparation, documentation, and advisory support. We ensure businesses remain compliant while focusing on growth.

Common VAT challenges in Bahrain include incorrect tax invoicing, delays in VAT return filing, missing documentation, and misinterpretation of VAT laws. VAT consultants like TopCertifier help businesses overcome these challenges effectively.

VAT in Bahrain applies across most industries including retail, manufacturing, trading, and services. However, specific exemptions exist for sectors like healthcare, education, and financial services. Businesses should consult experts for sector-specific VAT rules.