WHY DO COMPANIES NEED AUDITING & ACCOUNTING SERVICES IN BAHRAIN?

Bahrain is a fast-growing business hub with thriving industries in Manama, Sitra, Hidd, and Askar. For companies operating in such a dynamic market, accurate financial reporting and auditing are essential for trust, compliance, and long-term success.

Whether it’s a startup in Seef, an SME in Salmabad, or a multinational in Manama, organizations depend on professional auditing and accounting services to maintain credibility with stakeholders, manage risks, and comply with Bahrain’s commercial and tax regulations.

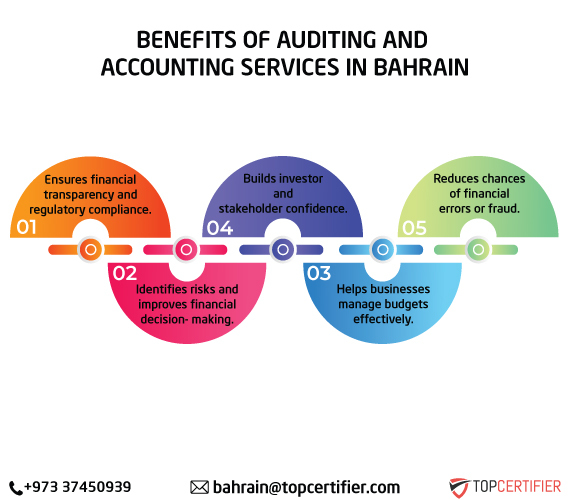

Proper accounting and auditing practices not only ensure compliance but also provide valuable insights into cost management, profitability, and business performance—making them a key driver of growth and sustainability in Bahrain.

ESSENTIAL RESOURCES FOR UNDERSTANDING AUDITING AND ACCOUNTING SERVICES IN BAHRAIN

Know More About Financial Audits & Compliance in Bahrain

Learn the importance of statutory audits, internal audits, and compliance reporting to keep your Bahrain business legally sound and financially transparent.

Roadmap for Efficient Accounting & Bookkeeping

Follow a clear roadmap for accurate bookkeeping, financial reporting, and tax accounting practices tailored for businesses across Bahrain.

Audit & Accounting Documentation Assistance

Simplify documentation, maintain precise financial statements, and ensure smooth compliance with Bahrain’s auditing and tax laws.

Internal Control & Risk Management

Identify financial risks, strengthen internal controls, and improve accountability within your organization to safeguard growth.

Role of Audit & Accounting Consultants in Bahrain

Work with expert consultants like TopCertifier to streamline financial processes, maintain compliance, and ensure reliable audits in Bahrain.

AUDITING & ACCOUNTING SERVICES IN BAHRAIN BY THE BEST CONSULTANT IN BAHRAIN

As a leading provider of Auditing & Accounting Services in Bahrain, TopCertifier ensures businesses stay compliant with financial regulations while enhancing performance and profitability. Our services are designed to meet the needs of startups, SMEs, and large enterprises, offering end-to-end support for accounting, compliance, and financial decision-making.

Ensure complete adherence to Bahrain’s commercial and financial laws with professional statutory audit support. Our experts deliver transparent audit reports that build stakeholder trust and strengthen business credibility.

Strengthen corporate governance and reduce risks through structured internal audit services. We help identify inefficiencies, enhance internal controls, and safeguard financial stability in line with Bahrain’s market requirements.

Maintain accurate records, streamline account management, and prepare financial statements with precision. Our bookkeeping and accounting solutions ensure smooth day-to-day financial operations and better business insights.

Get expert guidance on Bahrain VAT regulations, tax filing, and compliance. We simplify the complexities of tax accounting, ensuring businesses avoid penalties and remain fully compliant with local laws.

Streamline payroll processing, salary calculations, and compliance with Bahrain’s labor laws. Our payroll services reduce administrative burden while ensuring employees are paid accurately and on time.

Make informed decisions with expert financial analysis, cost management strategies, and business advisory services. We help organizations enhance profitability, improve efficiency, and plan for sustainable long-term growth.

With a team of highly experienced auditors and accountants, TopCertifier provides customized financial solutions that align with your industry and business size. From startups in Seef and Salmabad to multinational enterprises in Manama and Muharraq, we ensure compliance, efficiency, and transparency in every aspect of financial management.

By partnering with TopCertifier, businesses in Bahrain gain a competitive advantage through accurate reporting, proactive risk management, and optimized financial processes. Our proven expertise makes us a trusted choice for companies seeking reliable Auditing & Accounting Services in Bahrain.

Trust Us To Lead The Way In Certification And Compliance

Knowledge And Expertise

Thorough Understanding Of The Framework, Its Requirements, And Best Practices For Implementation

Proven Track Record

Successful Track Record Of Helping Clients Achieve Compliance, With Positive Client Testimonials And Case Studies.

Strong Project Management Skills

Ensure The Compliance Engagement Runs Smoothly And Is Completed On Time And Within Budget.

Experienced Team

Possession Of Experienced Professionals, Including Auditors, Consultants, And Technical Experts

Exceptional Customer Service

Committed To Excellent Customer Service With Clear Communication, Responsive Support, And A Focus On Satisfaction.

Competitive Pricing

We Prioritize Delivering High-Quality Services With Competitive Pricing That Provides Exceptional Value To Our Clients

FAQs

FREQUENTLY ASKED QUESTIONS

They include financial audits, statutory compliance, bookkeeping, tax accounting, and advisory services to ensure accurate financial management and legal compliance.

All companies registered in Bahrain, including startups, SMEs, and large corporations, require auditing for compliance and transparency.

Statutory audits, internal audits, compliance audits, and risk-based audits are the most common.

They ensure accurate financial reporting, compliance with tax laws, cost control, and better decision-making.

Yes, most registered companies in Bahrain are required to undergo statutory audits as per legal requirements.

Company financial statements, invoices, payroll records, tax filings, and supporting documentation.

Absolutely. Even small businesses gain credibility, financial insights, and compliance support through these services.

We provide end-to-end services including bookkeeping, tax accounting, statutory audits, compliance support, and financial advisory.

No. They are applicable to all industries including manufacturing, retail, hospitality, healthcare, IT, and financial services.

You can contact TopCertifier for a free consultation, eligibility check, and tailored accounting or auditing support based on your business needs.